Table of Contents

Cryptocurrency mining is one of the core mechanisms behind Proof-of-Work (PoW) blockchains like Bitcoin, Ethereum Classic, and Ravencoin. It ensures network security, validates transactions, and controls the issuance of new coins. But beyond its technical role, mining also has a significant impact on cryptocurrency prices, influencing supply dynamics, investor sentiment, and market volatility.

In this article, we’ll explore how mining affects crypto prices both from a theoretical perspective and in real-world scenarios. We’ll also highlight how platforms like EMCD https://emcd.io/pool/, a leading mining pool, help miners optimize their operations while indirectly contributing to market stability and transparency.

What Is Mining’s Role in the Crypto Ecosystem?

Mining is the process by which new blocks are added to a blockchain. Miners use computing power (hashrate) to solve complex cryptographic puzzles, and in return, they receive newly minted coins as a reward — along with transaction fees.

This process not only secures the network but also influences:

- The rate at which new coins enter circulation

- The cost of maintaining network security

- Market psychology around scarcity and inflation

EMCD: Supporting Miners and Influencing Market Dynamics

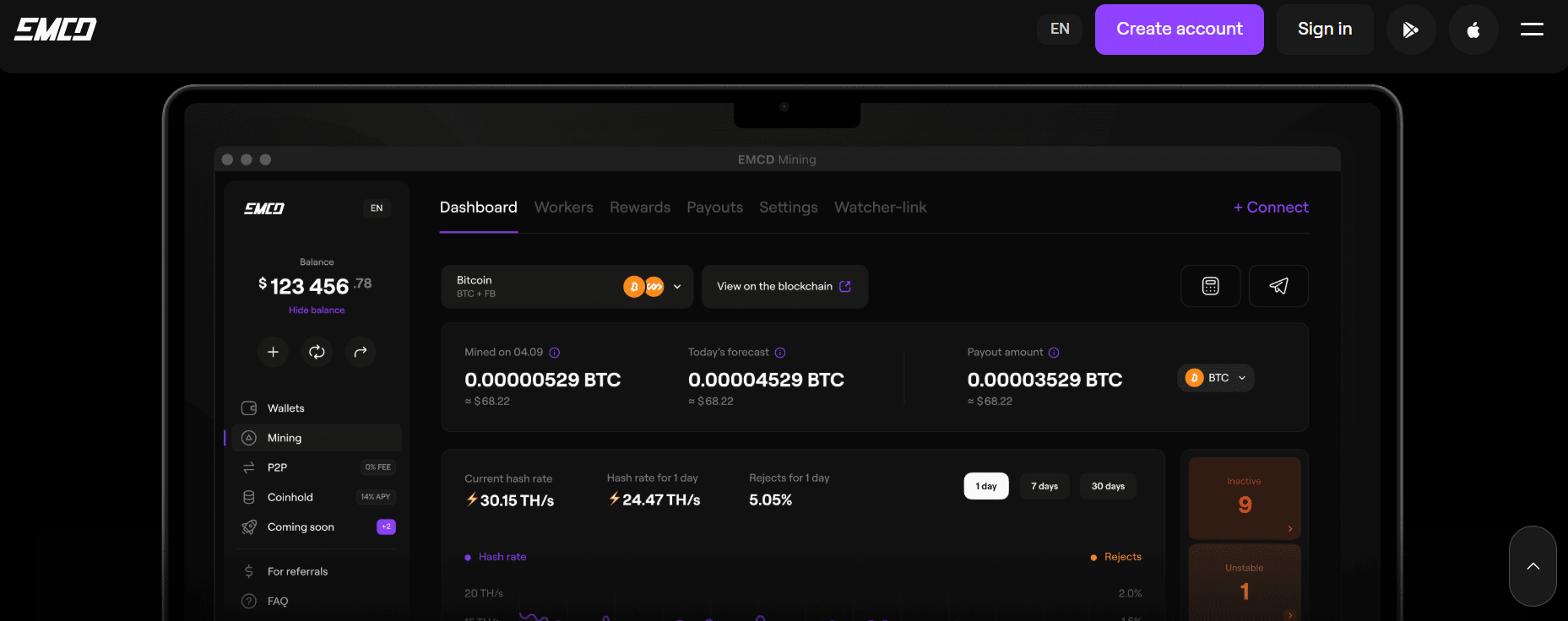

One of the most reliable and transparent platforms for cryptocurrency miners is EMCD . As a multi-algorithm mining pool, it supports coins like BTC, ETH, RVN, and ZEC, offering users:

- Real-time monitoring of hash rates and payouts

- Transparent reward systems (PPLNS, PPS)

- Low latency servers for maximum efficiency

- Mobile app integration for on-the-go management

By enabling thousands of miners to efficiently earn crypto, EMCD plays an indirect yet important role in shaping supply-side economics — a factor that can influence price trends over time.

Theoretical Impact of Mining on Crypto Prices

From an economic theory standpoint, mining affects cryptocurrency prices in several key ways:

1. Supply Inflation

Most PoW cryptocurrencies have a fixed or decreasing emission schedule (e.g., Bitcoin halving every 4 years). More miners joining the network increase the total hashrate, which can lead to faster block times — though difficulty adjustments usually counteract this.

However, higher miner revenue means more coins are being sold to cover costs like electricity and hardware upgrades — increasing short-term selling pressure.

2. Cost of Production

Miners must sell a portion of their mined coins to sustain operations. This creates a “cost of production” floor , below which many miners may stop mining due to unprofitability.

If prices drop below this level for too long, miners shut down rigs, reducing the network’s hashrate and potentially signaling a bottom in the market.

3. Scarcity and Halvings

Events like Bitcoin halvings reduce the number of new coins entering the market, creating artificial scarcity. Historically, these events have preceded bull runs — suggesting a strong link between mining rewards and price movements.

4. Network Security and Investor Confidence

A high hashrate indicates a secure network, which boosts investor confidence. If mining becomes centralized or drops significantly, investors may perceive the network as vulnerable — causing sell-offs.

Real-World Examples: Mining and Price Correlation

Let’s look at some real-life examples of how mining activity has impacted cryptocurrency prices:

📈 Bitcoin (BTC)

- In 2020–2021, Bitcoin saw a surge in institutional interest, but it was also accompanied by a rise in mining activity. New ASIC farms in North America and Canada increased the global hashrate, reinforcing network strength.

- After the May 2021 Chinese mining ban, the hashrate dropped by over 50%, causing a sharp price correction. However, as miners relocated and resumed operations, the network recovered — and so did BTC’s price.

📉 Ethereum (ETH)

- Ethereum’s transition to Proof-of-Stake in September 2022 marked the end of GPU mining for ETH. Before the merge, many miners sold off ETH ahead of the change, creating downward pressure.

- Post-merge, GPU miners shifted to alternatives like Ethereum Classic (ETC) and Ravencoin (RVN) , temporarily boosting those markets.

💡 Ravencoin (RVN)

- Ravencoin, a GPU-mineable asset, saw increased attention when Ethereum became less profitable for GPU miners after the merge. The influx of miners boosted RVN’s hashrate and visibility — contributing to a short-term price rally.

Final Thoughts

While mining itself doesn’t directly set cryptocurrency prices, it plays a crucial role in shaping them through:

- Supply dynamics

- Cost of production

- Network security

- Investor sentiment

Platforms like EMCD empower miners to operate efficiently, ensuring stable coin distribution and helping maintain network integrity. Whether you’re a miner, investor, or simply curious about market forces, understanding the relationship between mining and crypto prices is essential for navigating the digital asset space.