If a dealer identifies a picture of technological examination on the diagram, he understands in which advice the activity is more likely to continue. It furthermore provides the possibility of comfortable access to the agreement. The indication to purchase or sell occurs at the stop of the construction of the diagram when the rate goes beyond it. As a statute, it is at this moment that the agreement is made. Each graphic model can shove the rate to a certain movement.

Therefore, dealers are inclined to observe graphical models to take advantage of upcoming rate activities in the predicted advice. Forex commerce prototypes are allocated to organizations banking on the probable path of the prototype rate. On diagrams of commerce assets, Forex classifies three fundamental categories of pictorial diagrams. Many dealers borrow different technical shapes in their technical examination. Some are utilized in tandem with other methods, while others work on their own. During the strong downward activity of the technical diagrams, we highlight this diagram. The impression of this diagram implies that the southern tendency is appearing to stop. This signal demonstrates that the pressure on buyers is strong and sellers are losing their stances, and the southern direction will soon shift to the northern one. In other phrases, the figure will demonstrate that the period has come to shut shorts and empty buy deals.

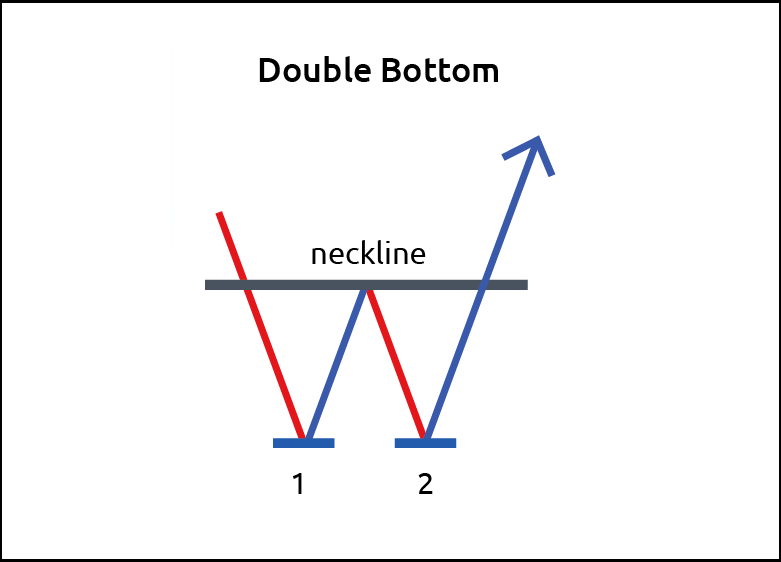

The double Bottom pattern is an illustrated prototype of a low trend deterioration in the technological examination. To determine the second bottom, the dealer must carefully regulate the rate manner. At the period when, on a low trend, the price of an economic device falls for the next period to a powerful level of assistance, but does not smash through it, after which it unfolds and starts up to rise, a dual bottom is shaped. Quotations are sloping in support, bounce, and then again attempt to smash through it, shaping «W». If the deterioration of assistance does not occur, then a diagram is constructed, which demonstrates the weakness of the recent direction, chatting about a possible reversal. This figure has its mirror pattern. On several instruments of the currency market, both of these figures appear quite often. Most trend turns are observed when one of these figures is present. These two graphical constructs are used not only to find entry points but also to determine exit times.